Long-term guaranteed protection

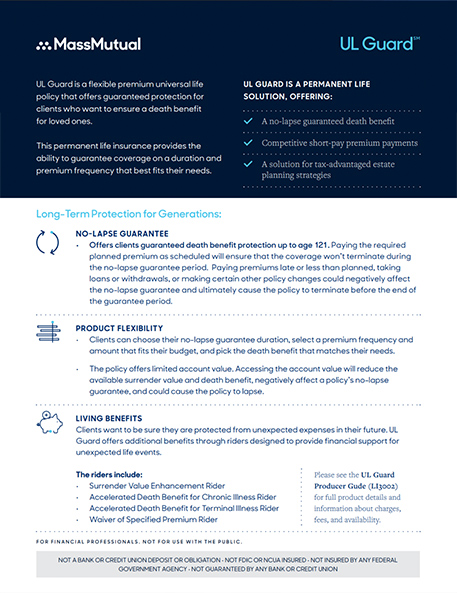

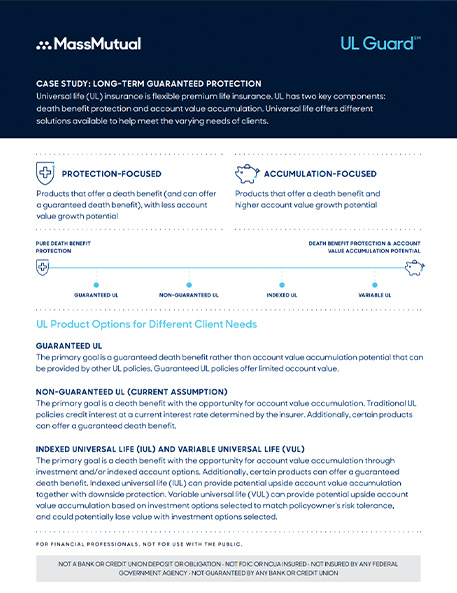

UL Guard is a flexible premium universal life policy that offers guaranteed protection for clients who want to ensure a death benefit for loved ones.

This permanent life insurance provides the ability to guarantee coverage based on a duration and premium frequency that best fits their needs.

What is UL Guard?

UL Guard is a flexible premium universal life insurance policy designed for clients who want permanent lifetime insurance protection with a guaranteed death benefit.

The policyowner can select the duration of the no-lapse guarantee, the premium amount, and the length of time to pay the required premiums.

UL Guard is a permanent life solution, offering:

- A no-lapse guaranteed death benefit

- Competitive short-pay premium payments

- A solution for tax-advantaged estate planning strategies

We also offer a second-to-die version of this product called SUL Guard. See information and resources for SUL Guard below.

Who It's For

UL Guard is an ideal choice for clients seeking affordable, long-term protection that fits their life — today and into the future.

Clients who want to address goals including:

- Protecting pre-retirement income for their loved ones

- Providing funds to pay final expenses

- Securing post-retirement life insurance for a surviving spouse

- Estate or legacy planning for their children and grandchildren

- Business continuation and succession planning

- Supporting charitable causes close to their heart

Target audience

Ages 45 – 75

No-lapse guarantee for life

Offers clients guaranteed death benefit protection up to age 121.

- Paying the required planned premium as scheduled will ensure that the coverage won’t terminate during the no-lapse guarantee period. Paying premiums late or less than planned, taking loans or withdrawals, or making certain other policy changes could negatively affect the no-lapse guarantee and ultimately cause the policy to terminate before the end of the guarantee period.

Product flexibility

- Policyowners can choose their no-lapse guarantee duration, select a premium frequency and amount that fits their budget, and pick the death benefit that matches their needs.

Living benefits

Every client's life is a unique story, and UL Guard is designed to help match that uniqueness. That's why we offer an array of additional benefits to further meet their needs. The riders include:

Surrender Value Enhancement Rider

Accelerated Death Benefit for Chronic Illness Rider

Accelerated Death Benefit for Terminal Illness Rider

Waiver of Specified Premium Rider

Please see the UL Guard Producer Guide (LI3002) for full product details and information about charges, fees, and availability.

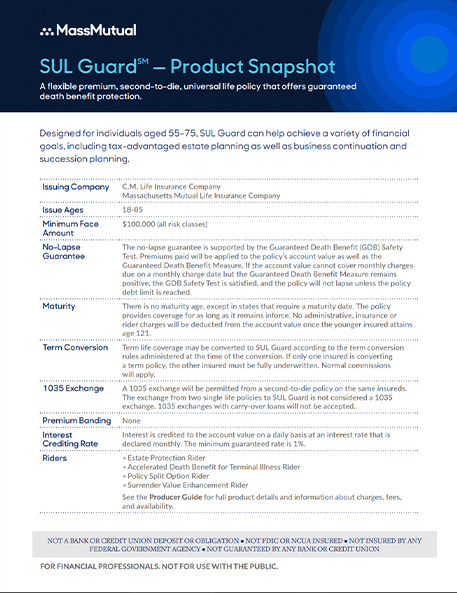

Survivorship Product — SUL Guard

SUL Guard is a flexible premium, second-to-die universal life policy.

Survivorship life insurance is a cost-effective way to fund certain planning goals, as premiums are lower than for a comparable amount of life insurance protection purchased on an individual life basis.

For clients who want to address goals including:

- Paying for final expenses

- Estate or legacy planning for children and grandchildren

- Business continuation and succession planning

- Charitable giving

- Supporting the care of a child with special needs

- Paying for end-of-life health care needs